If you earn income that isn’t subject to regular withholding, such as self-employment income, dividends, or rental income, you may need to make estimated tax payments. Estimated taxes help you stay on track with the IRS and your state of filing and avoid penalties at tax time.

Who Pays Estimated Taxes

Not everyone is required to make estimated payments, but many individuals and businesses do. Here are the basic rules:

- Individuals – This includes sole proprietors, partners, and S corporation shareholders. You generally need to pay federal estimated taxes if you expect to owe $1,000 or more when you file your return. Most states have a similar rule, often with a threshold between $500 and $1,000.

- C Corporations – Corporations must pay estimated taxes if they expect to owe $500 or more.

- Partnerships & S Corporations – These entities generally do not pay income tax at the federal level. Instead, profits pass through to the owners, and the partners or shareholders are responsible for making their own estimated payments. In Connecticut, partnerships and S Corps may elect to pay the Pass-Through Entity Tax (PET) at the entity level. If the election is made, they are required to pay estimated tax payments if they expect to owe $1,000 or more.

General Rule of Thumb – If you owed taxes the previous year, you may need to make estimated payments the following year. For example, if think you’ll owe $10,000 for the upcoming year, we suggest plan to pay $2,500 each quarter as best practice to protect yourself or your business from accruing penalties and interest.

At Ciampi Tax, upon final processing of your tax return – if you owe monies and chose to make the estimated tax payments – we provide tax payment vouchers that can be submitted on a quarterly basis.

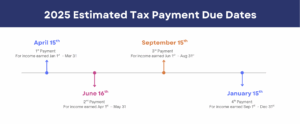

When to Pay Estimated Taxes

The tax year is divided into four quarterly payment periods, each with its own due date. Paying on time is critical to avoid penalties, even if you expect a refund when you file your annual return. The IRS and state agencies typically follow the same deadline dates.

If a deadline falls on a weekend or federal holiday, the payment will be considered on time if made the following business day.

Please note you can also set up weekly, biweekly, or monthly payments with the IRS or state agency directly.

Below are multiple ways to make estimated tax payments to the IRS and the State of CT, whether as an individual taxpayer or a business.

Ways to Pay Estimated Taxes – IRS

For Individuals

- Online (fastest & easiest)

-

- Log into your IRS Online Account.

- Select “Make a Payment” and choose “Estimated Tax”.

- Pay directly from your checking or savings account using Direct Pay (no fees), or use a debit/credit card (fees apply).

- Keep the confirmation number for your records.

Without Using an Account: If you prefer, you can also use IRS Direct Pay without logging in. You enter your Social Security number, name, and bank details to submit a payment.

- By Mail with Printed Payment Vouchers

Note: In July 2025, the President signed an Executive Order requiring the IRS to stop accepting and issuing paper checks beginning October 1, 2025. This is expected to impact refunds and estimated tax payments. While the IRS has not yet issued specific instructions, mailed check and voucher payments may be phased out. We will update this page as new information becomes available. Join our newsletter to be notified first of any changes.

-

- Use a payment voucher provided to you with your tax return.

- Write a check or money order made out to: “United States Treasury”

- Include your name, address, Social Security number, tax year, and “Form 1040-ES” on the check.

- Mail the payment and voucher to the IRS address listed.

- By Phone

-

- Call one of the IRS-approved payment processors listed on IRS.gov/payments.

- You can pay using a debit or credit card (processing fees apply).

- Keep your confirmation number for proof.

- IRS2Go Mobile App

-

- Download the IRS2Go app on iOS or Android.

- Make a secure payment directly from your bank account or card.

- You can also check your payment history from the app.

- Through Your Bank (Same Day Wire)

-

- Contact your bank for fees and setup.

- Use this option if you need to make a large or last-minute payment.

For Businesses

Businesses have a few different payment options depending on their entity type. They should make all estimated payments through EFTPS or their IRS Business Online Account.

Here’s how to make sure your payments are on time and properly applied:

- Electronic Federal Tax Payment System (EFTPS)

-

- Ensure you are enrolled at EFTPS.gov (for newly created businesses)

- Once enrolled:

- Log in to your EFTPS account.

- Choose “Make a Payment.”

- Select “Estimated Tax” as the payment type.

- Enter the tax period and amount due.

- Schedule same-day or future-dated payments.

- You’ll receive a confirmation number as proof of payment.

Tip: EFTPS allows you to schedule recurring payments for all four quarterly deadlines in advance.

- Business Online Account (IRS.gov/account)

-

- Once logged in, you can:

- View your payment history.

- Make estimated payments using Direct Pay for businesses.

- Payments come directly from your bank account (no fees).

- Once logged in, you can:

Ways to Pay Estimated Taxes – Connecticut

Partnerships and S Corporations are required to pay electronically and may face penalties if they do not.

- Payment Made Through myConnect

Individuals and businesses who already have a myConnect account may log in and pay through there.

-

- On the home page, click “Make a Payment or Estimated Payment” from the Individuals pane

- Click “Make an Estimated Payment” from the Estimated Payment pane

- Fill out your information, enter banking information and complete

- By Mail with Payment Voucher

-

- Connecticut also provides paper vouchers (CT-1040ES) for mailing estimated tax payments with a check.

- Contact us to prepare these vouchers for you, similar to IRS Form 1040-ES.

- Mail payments to the CT DRS address provided with the voucher.

Estimated tax payments are always a confusing issue for many of our client each year. If you have any questions, please email or call our office and we will be happy to answer any questions you may have.